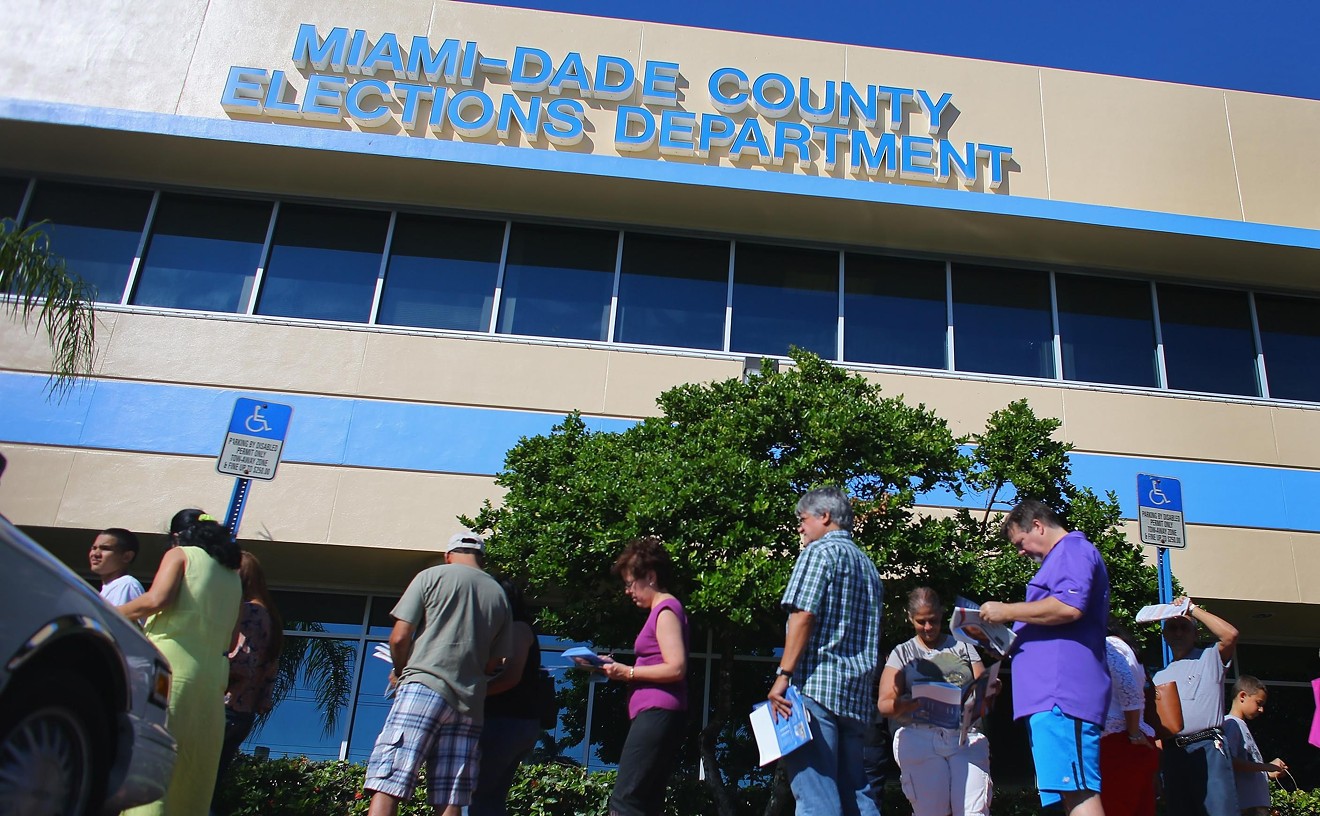

One of these ladies standing up to big banks and a complicit government was Lynn Szymoniak, of Palm Beach Gardens, the victim of a fraudulent foreclosure herself.

After Szymoniak uncovered the tricks banks were using to perpetrate fraud, she served as a whistleblower, helping the feds win a $95 million settlement from the banks (a pittance compared to what they stole) and an $18 million chunk of change for herself.

But now comes the big reveal. The lawsuit — and thus, the evidence in that case — had been sealed but was unsealed earlier this month. It includes things like paperwork showing a bank got the rights to a home — after the bank had already foreclosed on it and kicked out the resident.

As Salon explained:

"The lawsuit states that banks resorted to fake documents because they could not legally establish true ownership of the loans when trying to foreclose. This reality, which banks did not contest but instead settled out of court, means that tens of millions of mortgages in America still lack a legitimate chain of ownership, with implications far into the future."

As BoingBoing put it:

"The banks screwed up the title transfers. A lot. They sold bonds backed by houses they didn't own. When it came time to foreclose on those homes, they realized that they didn't actually own them, and so they committed felony after felony, forging the necessary documentation. They stole houses, by the neighborhood-load, and got away with it. The... settlement sounded like a big deal, back when the evidence was sealed. Now that Szymoniak's gotten it into the public eye, it's clear that [the settlement] was a tiny slap on the wrist: the banks stole trillions of dollars' worth of houses from you and people like you, paid less than one percent in fines, and got to keep the homes."

Szymoniak is now free to move forward with her own lawsuit against the 28 banks and mortgage companies, including JPMorgan Chase, Wells Fargo, Citi, and Bank of America. In the meantime, she's started an organization called the Housing Justice Foundation to educate people about these issues and expose mortgage fraud. Szymoniak did not return a call for comment.